Customer scorecards and predictive analysis models.

For those of you new to the concept of using scores within customer scorecards for database segmentation, profiling and to then select individuals for targeting, the following example should help.

Most people have at some time applied for an insurance policy or credit of some kind – a loan, mortgage, finance for a new car, etc. – and during the application process have been asked questions such as age, length of residency, how many credit cards, health history, etc.

For each of the answers given, data will have been entered into a computer program that assigns a number (or score) to each piece of information.

This is usually termed a customer score card. The way the numbers are then added together will depend on the formulae used, but will greatly influence the decision to give you what you are requesting.

The important thing to remember is that whilst each separate piece of information may in its own right not be seen as important and might otherwise be ignored, only when these items are combined does the resulting information and its score become significant and predictive.

A predictive model would usually be created by a statistician and used to compare the characteristics (or profile) of individuals who are known to represent, for example, a good vs. bad risk. This produces a formulae and computes a value (or score) for each individual. Depending on how high or low the final score is, the lender or insurer can determine the most appropriate offer for that individual and be fairly confident in the degree of risk.

The picture to the right shows an example of how important various pieces of information are in predicting who might respond to a specific type of mailing or email campaign.

Direct marketing – using scores and customer scorecards to target prospects

In direct marketing, to find the most likely responders for your offer could well involve making hundreds of separate or combined counts and selections, and then using only the information you believe is important – i.e. maybe missing key predictors!

However, by using a customer scorecard process, the selection task can be greatly simplified. Each individual can be allocated a single score based on their propensity to take the kind of action you desire. There will never be a single model or formula that meets all your targeting or profiling needs however.

[pullquote style=”left” quote=”dark”]What works well today may not work so well in the future[/pullquote]

A separate model and scoring formulae may need to be created to optimise the targeting and response to each different offer you make, or to achieve the results you desire. Remember, customer needs change over time as do the activities of your competitors.

What works well today may not work so well in the future, so the art is to continually test, learn and refine to get the most from your marketing spend!

Profiling – using tools such as FastStats to simplify the process

Profiling in market targeting is used to compare the distribution of a group of individuals – based on their purchasing, behaviour, etc., characteristics – relative to other individuals on your customer or prospect database.

Once a profile has been created, a marketer can then build predictive models based on the results of that profile.

Predictive models are used to score and segment your marketing database to, for example, find prospects that ‘look like’ your existing high value customers. This process helps you test and purchase only the most responsive lists.

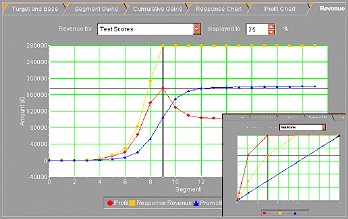

The model reports to the right illustrate potential gains, revenues and profits and has been created using FastStats.

Example Applications – by no means an exhaustive list!

- Selection of look-alike prospects (i.e. prospects who match the profile of selected customers)

- Using scoring to grade and select the best prospects from third party lists.

- Using scoring to grade prospects to prioritise contact strategies by mail, e-mail, telemarketing or face to face channels.

- Using different analysis selections, base marketing priorities on: financial risk or likelihood to churn (lapse or defect), respond, purchase, upgrade, etc.

- Profiling responders against the base of all those marketed to in a test campaign, and score prospects in order to prioritise who to select for the roll-out campaign.

- Developing sales and franchise territories, and identifying where best to position outlets.

For more applications please visit our Customer Insight page.